The realization concept is beneficial for businesses that experience seasonal fluctuations in sales or businesses that are heavily dependent on cash flow. It allows for a more accurate picture of a company’s financial position and eliminates distortions that can be caused by the timing of cash receipts and payments. Additionally, this method may provide a more timely indication of a company’s performance when compared to the accrual basis of accounting. The concept of realization is interpreted and applied differently across various accounting frameworks, reflecting the diverse regulatory environments and economic contexts in which businesses operate. In the United States, the Generally Accepted Accounting Principles (GAAP) emphasize the realization principle as a cornerstone of revenue recognition. Under GAAP, revenue is realized when it is earned and there is reasonable assurance of collectability.

Investment Property Accounting: Standards, Valuation, Reporting

The realization approach to financial transactions is not without its limitations. The primary issues with the realization principle are that it may lead to overstating available cash, recording revenue too early and having delays and cancellations affect clients’ realized revenue. Double entries may also be an issue when recording payments before they are received. By utilizing the realization concept, businesses can benefit from improved financial visibility and cash flow management.

Revenue Recognition: What Is the Milestone Method?

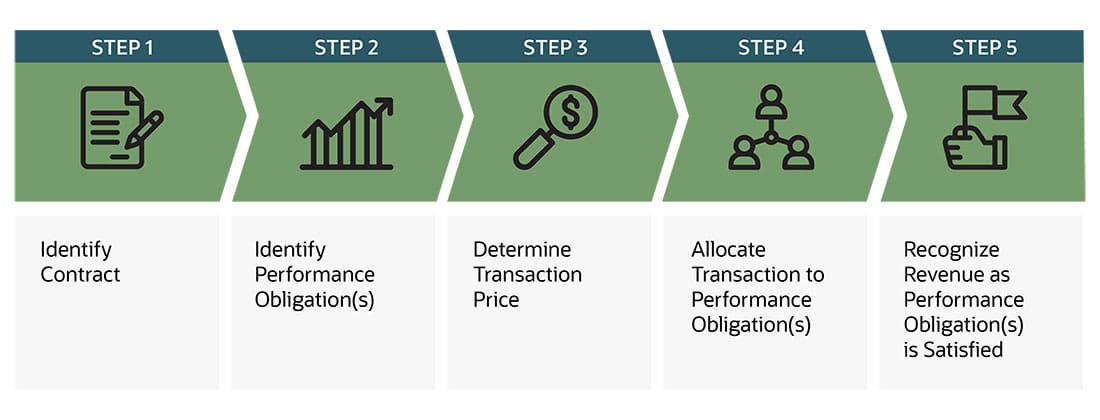

So, it doesn’t take much for them to grasp the idea that these principles, in fact, complement, guide, and work perfectly in tandem with revenue recognition standards like ASC 606 and IFRS 15. And, thankfully, they do—because these guidelines give busy accounting teams the tools they need to correctly recognize revenue so their companies’ financial reports remain accurate and consistent. It’s crucial to navigate these challenges effectively to maintain financial integrity. To start, be careful not to recognize revenue too early, especially for long-term contracts, so you don’t mislead investors with your financials.

(i). When revenue is referred to as earned?

Tax authorities often have specific rules that align with or diverge from standard accounting practices. In the United States, the Internal Revenue Service (IRS) requires businesses to follow the realization principle for tax purposes, ensuring that income is taxed when it is realized. This alignment helps in maintaining consistency between financial reporting and tax reporting, reducing the risk of discrepancies that could trigger audits or penalties.

- However, when done manually, it’s still a tremendously tiresome and monotonous ordeal filled with many complexities and nuances.

- The current statements are tentative and only reflect the financial position of that particular period of time.

- ASC 606 streamlined the whole process, making it the same for everyone who enters into contracts with customers.

The Core Principles of the Realization Concept

However, making these determinations quickly becomes much more complicated when a company sells and delivers the goods or services at a later date or over time. A product is manufactured, sold on credit and the revenue is recognized at the time of the sale. To match the expenses of producing the product with the revenues generated by the product, the expenses and revenues are recognized simultaneously. Auditors must be aware of the limitations of the realization concept and be diligent in monitoring financial transactions to ensure accuracy and compliance with generally accepted accounting principles. This includes establishing internal control systems and providing oversight to ensure these controls are functioning properly. Realization concept offers a useful tool for businesses as it provides an opportunity to review financials without waiting for full payments to go through and provides customers with more payment options.

Revenue Recognition Criteria

When ASC 606 was issued in 2014, it significantly transformed revenue recognition practices in the US by introducing a unified and principles-based framework that aligns GAAP with international accounting standards. As we’ve discussed, it requires companies to recognize revenue based on transferring goods or services to customers at an amount that reflects the consideration to which the company expects to be entitled. The ASC step framework, jointly established by the FASB and the IASB in 2014, works with the revenue recognition principle, GAAP, and International Financial Reporting Standards (IFRS) to shape a company’s financial statements.

The realization principle provides an opportunity to review financials in a timely manner, prior to payments being received, which can help to create accurate budgets and identify available cash. As well, the ability to track payments on an individual level allows businesses to assess customer behavior and inform their marketing and sales strategies. The last exception to the revenue recognition principle is companies that recognize revenue when the cash is actually received. This is a form of cash basis accounting and is most commonly found in installment sales. The timing difference between realization and recognition can have significant implications for financial reporting.

The credit card company charges MaineLobster Market a 4% fee, based on credit sales using its card. Fromthe following transactions, prepare journal entries for MaineLobster Market. As mentioned, the revenue recognition principle requires that,in some instances, revenue is recognized before receiving a cashpayment. This money owed to the company is a type of receivable forthe company and a payable for the company’s customer. Revenue and expense recognition timing is critical totransparent financial presentation. Even though GAAP isrequired only for public companies, to display their financialposition most accurately, private companies should manage theirfinancial accounting using its rules.

This principle dictates that expenses should be recorded in the same period as the revenues they help generate. For instance, if a company incurs costs to produce goods that are sold in a particular quarter, those costs should be reported in the same quarter as the sales revenue. This alignment helps in presenting a clear and consistent view of profitability over time. It allows customers to pay with cash, an in-house creditaccount, or a credit card.

This typically means that the good or service has been delivered to the customer and they now have control over it. Realization concept requires that revenue shall not be recognized on the basis of cash receipts but should rather be recognized on accruals basis. The revenue has to be recognized when it is realized, not when an order is received. In this second example, according to doubtful accounts and bad debt expenses the realization principle of accounting, sales are considered when the goods are transferred from Mr. A to Mr. B. There must also be a reasonable expectation that the revenue will be realized either presently or in the future. The thing to note is that revenue is not earned merely when an order is received, nor does the recognition of the revenue have to wait until cash is paid.