Conversely, a lower ratio indicates that the company primarily uses equity, which doesn’t require repayment but might dilute ownership. On the other hand, a business could have $900,000 in debt and $100,000 in equity, so a ratio of 9. “In a case like that, the lenders almost completely financed the business,” says Lemieux.

Importance of the Debt to Equity Ratio

An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less.

Debt to Equity Facts

In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy. However, it could also mean the company issued shareholders significant dividends. In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). When using the D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value that’s common in one industry might be a red flag in another.

What is considered a bad debt-to-equity ratio?

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Company B has quick assets of $17,000 and current liabilities of $22,000. The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. Quick assets are those most liquid current assets that can quickly be converted into cash.

- Mining and pharmaceutical companies typically have higher Betas, but they also offer higher potential returns for investors.

- Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

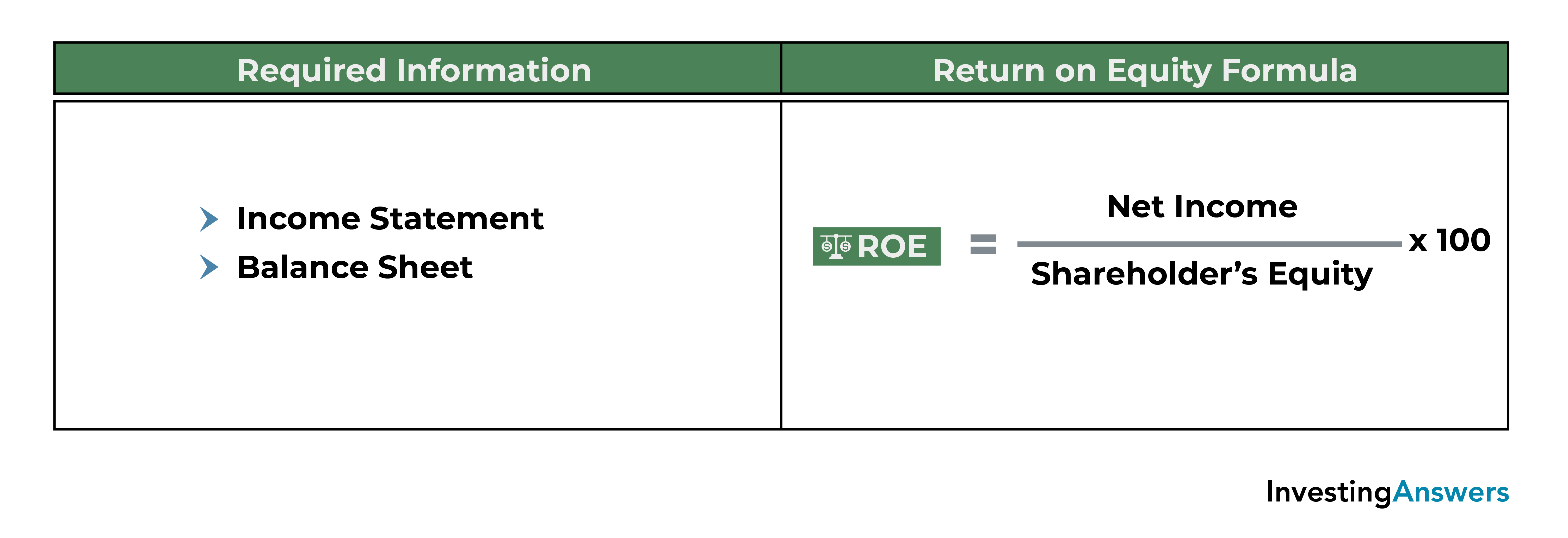

- Shareholder equity represents the value of the company’s assets minus its liabilities, indicating the amount owned by shareholders.

- If earnings outstrip the cost of the debt, which includes interest payments, a company’s shareholders can benefit and stock prices may go up.

- These assets include cash and cash equivalents, marketable securities, and net accounts receivable.

How to calculate the debt-to-equity ratio?

Either way, the CoE factors in, along with the cost of debt, when calculating your weighted average cost of capital (WACC). Be sure to study these concepts if you’re planning on doing a round of fundraising. It’s calculated using the current treasury bill (T-bill) rate or the long-term yield of government bonds. Due to their government backing, these are considered “safe” or “risk-free” investments. Investors are looking for higher returns, but RF is a good number to use as a baseline for cost-of-equity calculations.

How Businesses Use Debt-to-Equity Ratios

Regularly monitoring the ratio against industry peers helps businesses maintain a healthy level of debt relative to equity. Investors and lenders often use this ratio to evaluate the company’s long-term stability and financial health. It helps assess the financial where’s my refund risk of a company, as higher debt levels might limit growth or lead to financial instability during economic downturns. The debt-to-equity ratio provides insights into a company’s ability to handle its debt obligations using its assets and shareholder equity.

For the investors and lenders, this high ratio will point towards investment with greater risks because the business might not be able to generate enough revenues to pay back the debts. The Debt to Equity Ratio (D/E ratio) is a key financial metric used to assess a company’s financial leverage. By comparing a company’s total liabilities to its shareholders’ equity, the D/E ratio provides insights into the financial structure and stability of a business. A well-balanced D/E ratio is crucial for understanding a company’s long-term solvency and risk profile.

Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. However, a low D/E ratio is not necessarily a positive sign, as the company could be relying too much on equity financing, which is costlier than debt. The D/E ratio represents the proportion of financing that came from creditors (debt) versus shareholders (equity). Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk.

But, if debt gets too high, then the interest payments can be a severe burden on a company’s bottom line. So in the case of deciding whether to invest in IPO stock, it’s important for investors to consider debt when deciding whether they want to buy IPO stock. In some cases, creditors limit the debt-to-equity ratio a company can have as part of their lending agreement.

This number is useful for investors because it measures the difference between an expected rate of return on your investment and the risk-free rate. If the MRP is negative, you’re better off investing in bonds or looking for equity elsewhere. When the debt to equity ratio is closer to zero, it means that the business is not utilizing the funds available to expand its operations. This could indicate to the investors that the company is not realizing its full potential or value. Although a high debt to equity ratio may seem alarming at first glance, it is not always so. Moreover, it could also indicate that the business has the leverage to give returns to its shareholders.

So, for example, you subtract the balance on the operating line of credit and the amounts owed to suppliers from the liabilities. “By keeping only the long-term debt, it is more revealing of the company’s true debt level,” says Lemieux. Short-term debt consists of liabilities that can be paid within a year’s time. As the business has to clear it within a short period, they are not considered a risk.